AI Agents for Travel Expense Compliance

Managing travel expenses manually is a costly and error-prone process for businesses. AI Agents for Travel Expense Compliance are designed to automate, enforce, and optimize expense management, ensuring policy adherence, fraud detection, and cost savings. These agents streamline workflows, reduce compliance risks, and free up valuable resources for strategic tasks.

discuss your projectENSURE POLICY COMPLIANCE WITH AI-POWERED TRAVEL EXPENSE MONITORING AGENTS

AI Agents for Travel Expense Compliance automate receipt processing, policy enforcement, and fraud detection—eliminating manual reviews and reducing compliance risks. Using machine learning and OCR, these agents validate expenses, detect anomalies, and flag policy violations in real time. Integrated with ERP, travel booking, and accounting platforms, they provide full visibility into spending and streamline approvals. Scalable and secure, they help businesses reduce costs, ensure compliance, and optimize travel-related workflows.

Challenges in Travel Expense Management

Travel expense management is riddled with inefficiencies and risks that cost companies millions annually. Here’s a breakdown of the key challenges:

-

Budget Overruns

Non-compliance with travel policies can inflate costs by up to 20%, as employees overspend on unapproved expenses like first-class flights or excessive hotel charges.

-

Fraud Risks

Expense reimbursement fraud accounts for 14% of all fraud cases, with a median loss of $36,000 per incident. Inflated mileage claims and personal expenses disguised as business costs are common issues.

-

Regulatory Compliance

Navigating complex tax laws and industry regulations is a constant challenge. Non-compliance can result in hefty fines, as seen in cases where companies faced $1.5 billion in penalties.

-

Resource Drain

Manual expense processing is time-consuming and inefficient, diverting finance teams from higher-value tasks. Automation could reduce processing costs by up to 75%.

How AI is Transforming Travel Expense Compliance?

Travel Expense Compliance AI Agents are revolutionizing how businesses manage travel costs. By automating receipt processing, policy enforcement, and fraud detection, these agents ensure compliance while saving time and money. They also provide real-time insights, enabling better decision-making and proactive budget management. Additionally, Automated Travel Expense Auditing Agents play a critical role in ensuring that every expense is reviewed for compliance, reducing the risk of errors and fraud.

Key Features of Our AI Agents for Travel Expense Compliance

Automated Travel Expense Auditing

Continuously reviews expense reports for policy and regulatory compliance, flagging violations instantly.

Receipt Data Extraction

Uses OCR and AI to extract and validate data from receipts, ensuring accuracy and reducing manual effort.

Policy Violation Detection:

Identifies expenses that exceed per diem limits, involve unapproved vendors, or violate company policies.

Fraud Detection

Leverages machine learning to detect anomalies and suspicious spending patterns.

Real-Time Monitoring

Tracks travel expenses continuously to ensure compliance and flag issues as they arise.

Personalized Recommendations

Suggests cost-effective travel options that align with both employee preferences and company policies.

Integration with Travel Booking Systems

Connects seamlessly with platforms like Navan and Expedia to access itinerary and expense data.

Automated Report Generation

Creates detailed compliance reports for management review.

Types of AI Agents in Travel Expense Compliance

Autonomous Agents

Handle the majority of expense reports without human intervention, automatically approving compliant submissions.

Co-Pilot Agents

Assist finance teams by flagging potential violations and providing insights for decision-making.

Autopilot Agents

Automate end-to-end workflows, from receipt processing to compliance checks, escalating only complex cases to human reviewers.

Human-in-the-Loop Agents

Collaborate with human auditors for sensitive or high-risk cases, ensuring a balance of automation and human judgment.

Ready to Streamline Travel Expense Compliance with AI Agents?

Discover how Bluebash’s intelligent AI agents can automate expense reviews, prevent policy violations, and enhance fraud detection—helping your business save time, reduce risk, and improve financial accuracy.

LET'S CONNECTWhich Work is Better Human Work Vs Agent Work

Human Work

Speed

Time-consuming, manual review

Accuracy

Prone to errors

Scalability

Limited by staff capacity

Cost

High labor costs

Fraud Detection

Difficult to detect complex fraud

Agent Work

Speed

Instantaneous analysis

Accuracy

Highly accurate and consistent

Scalability

Handles large volumes effortlessly

Cost

Lower operational costs

Fraud Detection

Advanced fraud detection algorithms

ROI of AI in Travel Expense Compliance

Implementing AI-Powered Travel Expense Management Agents delivers measurable benefits:

Cost Savings

Reduces travel expenses by 10-15% in the first year.Efficiency Gains

Cuts expense report processing time by 50-70%.

Improved Compliance

Boosts compliance rates by 20-30%, reducing the risk of fines.

Fraud Prevention

Detects and prevents expense fraud at scale.

Enhanced Decision-Making

Provides real-time insights for proactive budget management.

AI Interface for Tax Professionals and Managers

Users interact with the tax compliance monitoring agent through:

Dashboards

Displays key metrics, compliance rates, and flagged violations.

Alerts

Sends notifications for policy violations and anomalies.

Approval Workflow

Automates routing of expense reports to designated managers.

Chat Interface

Offers conversational support for employees submitting expenses.

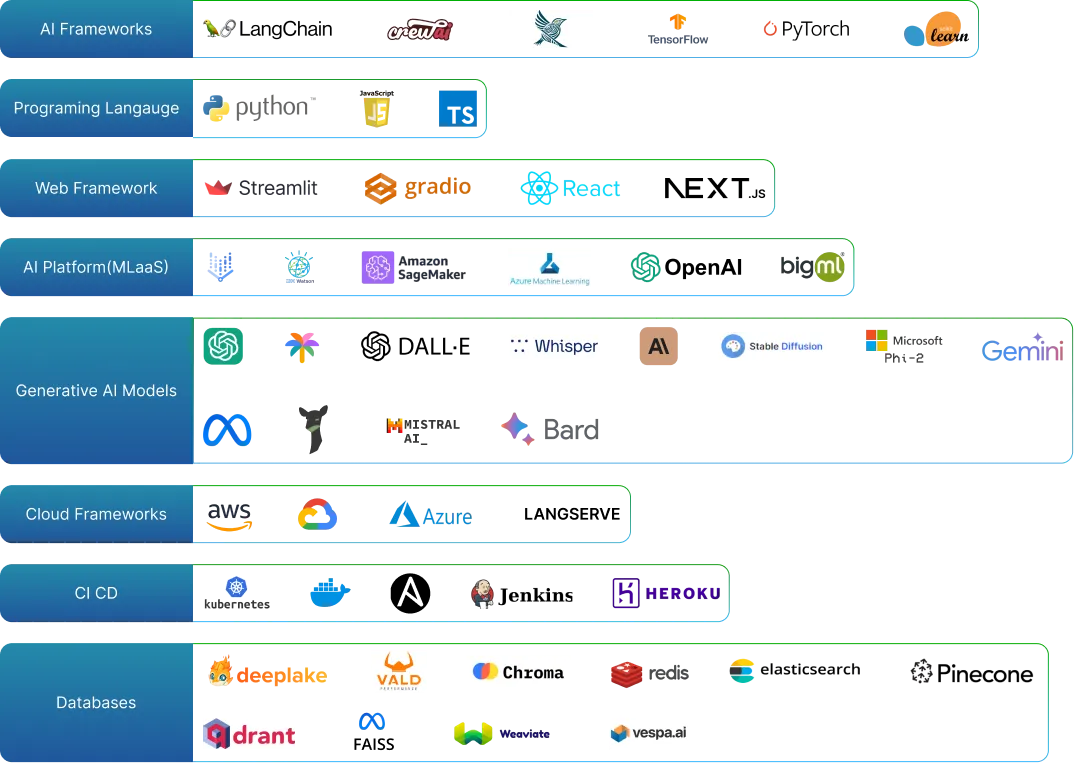

Artificial Intelligence Tools and Platforms

Explore cutting-edge AI tools and platforms for advanced analytics, machine learning, natural language processing, and innovative solutions.

Frequently Asked Questions

These are AI-powered tools that automate expense management, ensuring compliance with company policies and regulations.

They use machine learning algorithms to identify anomalies and suspicious spending patterns, flagging potential fraud for review.

Yes, they integrate seamlessly with ERP systems, travel booking platforms, and accounting software.

The agent flags the violation and routes it to a human reviewer for further action.

By automating expense processing, employees experience faster reimbursements and fewer delays.