AI Agents for Payroll Audit Compliance

Managing payroll compliance is a complex and high-stakes task for businesses. Our AI Agents for Payroll Audit Compliance are designed to automate and streamline this process, ensuring accuracy, compliance, and efficiency. These agents help organizations avoid costly penalties, reduce manual effort, and stay ahead of ever-changing tax laws and labor regulations.

discuss your projectENSURE PAYROLL COMPLIANCE WITH AI-POWERED AUDITING AGENTS

Bluebash’s AI Agent for Payroll Audit Compliance automates audits, detects anomalies, and ensures adherence to tax laws and labor regulations. It monitors compliance in real time, generates detailed reports, and integrates seamlessly with ERP, HRIS, and accounting systems. With a smart dashboard, chat interface, and human-in-the-loop support, it enables faster, more accurate, and secure payroll compliance management.

Challenges in Payroll Compliance

Payroll compliance is a significant challenge for businesses due to its complexity and the risks involved. Tax laws and labor regulations are constantly evolving, making it difficult for organizations to stay compliant. Manual processes are prone to errors, which can lead to financial penalties, legal disputes, and reputational damage. Additionally, periodic audits often fail to catch issues in real time, leaving businesses exposed to risks. This is where Payroll Audit Compliance AI Agents step in, automating compliance checks and ensuring continuous monitoring. By leveraging Payroll Audit Intelligence AI Agents, businesses can proactively address compliance challenges and reduce risks. The integration of Payroll Policy Compliance AI Agents further strengthens compliance efforts by ensuring adherence to company-specific policies.

How AI is Transforming Payroll Compliance?

AI is revolutionizing payroll compliance by automating repetitive tasks, improving accuracy, and providing real-time insights. With AI-Powered Payroll Auditing Agents, businesses can ensure compliance with minimal human intervention. These agents continuously monitor tax laws, labor regulations, and internal policies, flagging potential issues before they escalate. By leveraging AI, companies can reduce manual effort, enhance decision-making, and mitigate compliance risks. Additionally, Automated Payroll Audit Compliance Agents provide a scalable solution for handling large datasets, ensuring compliance across diverse payroll systems. Our AI-Based Payroll Auditing Solution further enhances this transformation by offering a user-friendly interface and seamless integration with existing systems. The inclusion of Payroll Policy Compliance AI Agents ensures that company-specific policies are adhered to, adding another layer of compliance assurance.

Key Features of Our AI Agents for Payroll Audit Compliance

Automated Payroll Audits

Conducts comprehensive audits to ensure compliance with tax laws and labor regulations.

Discrepancy Detection

Identifies errors, inconsistencies, and potential fraud in payroll data.

Compliance Monitoring

Continuously tracks changes in tax laws, labor regulations, and company policies.

Risk Assessment

Evaluates payroll processes to identify and mitigate compliance risks.

Automated Reporting

Generates detailed audit reports with actionable recommendations.

Data Validation

Ensures payroll data accuracy by validating it against predefined rules.

Workflow Automation

Streamlines the review and approval process for compliance issues.

Anomaly Detection

Flags unusual patterns in payroll data for further investigation.

Predictive Analytics

Forecasts potential compliance issues based on historical data.

Security Features

Protects sensitive payroll data with encryption and fraud detection mechanisms.

AI-powered Payroll Accuracy Checker

Ensures payroll data is error-free and compliant with regulations.

Payroll Policy Compliance AI Agents

Provide advanced tools to ensure adherence to company-specific payroll policies.

Types of AI Agents in Payroll Audit Compliance

Autonomous Agents

Handle end-to-end payroll compliance tasks, including audits and reporting, with minimal human involvement.

Co-Pilot Agents

Assist HR and finance teams by providing real-time insights and recommendations during payroll reviews.

Autopilot Agents

Automate the entire compliance process but flag complex cases for human review.

Human-in-the-Loop Agents

Allow human intervention for sensitive or high-stakes compliance issues, ensuring a balance between automation and oversight.

Smart AI Agents for Payroll Audit Compliance

Combine advanced analytics and automation to deliver intelligent solutions for payroll compliance challenges.

Ready to Simplify Payroll Compliance with AI Agents?

Discover how Bluebash’s intelligent AI agents can automate audits, monitor compliance in real time, and reduce the risk of penalties—freeing up your team to focus on strategy instead of spreadsheets.

LET'S CONNECTWhich Work is Better Human Work Vs Agent Work

Human Work

Speed

Time-consuming, manual calculations

Accuracy

Prone to errors

Scalability

Limited by staff capacity

Cost

High labor costs

Compliance

Reactive, often after issues arise

Agent Work

Speed

Instantaneous analysis

Accuracy

Highly accurate and consistent

Scalability

Handles large datasets effortlessly

Cost

Reduced costs through automation

Compliance

Proactive, continuous monitoring

ROI of AI in Payroll Compliance

Implementing AI Agents for Payroll Audit Compliance delivers measurable benefits:

Cost Savings

Automation reduces labor costs and minimizes penalties.Improved Efficiency

Streamlined processes save time and resources.

Enhanced Accuracy

Fewer errors lead to fewer disputes and rework.

Risk Mitigation

Proactive identification of compliance risks prevents costly issues.

Time Savings

Automated audits free up HR and finance teams for strategic tasks.

Scalability

Easily handles large volumes of payroll data without additional resources.

Intelligent Payroll Regulation Agents

Provide advanced insights and predictive analytics to optimize compliance strategies.

AI Interface for Payroll Teams

Our AI-Based Payroll Auditing Solution offers a user-friendly interface designed for payroll, HR, and finance teams:

Dashboards

Displays payroll status, compliance metrics, and audit findings in a clear, actionable format.

Automated Alerts

Sends real-time notifications for compliance issues and risks.

Reporting Tools

Provides customizable reports with detailed analysis and recommendations.

Chat Interface

Offers instant answers to payroll compliance questions.

Minimal User Involvement

Automates most tasks, requiring human input only for approvals or complex cases.

Payroll Policy Compliance AI Agents

Ensure seamless integration with existing systems for enhanced compliance management.

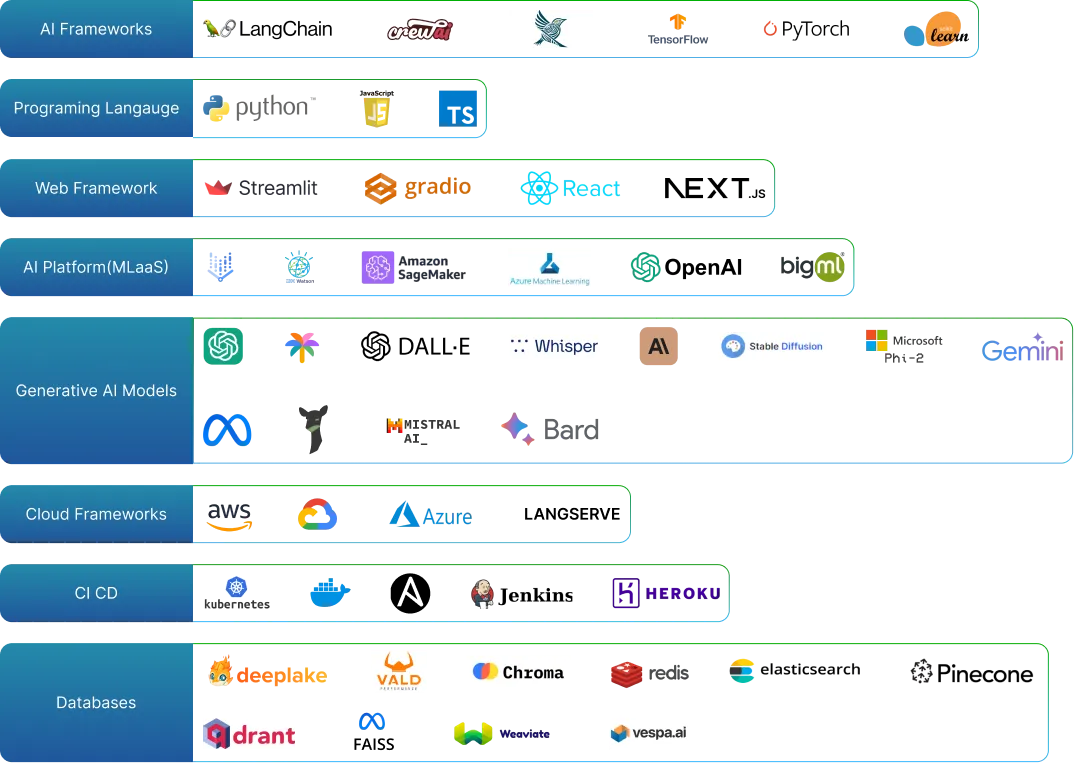

Artificial Intelligence Tools and Platforms

Explore cutting-edge AI tools and platforms for advanced analytics, machine learning, natural language processing, and innovative solutions.

Frequently Asked Questions

These are AI-powered tools that automate payroll audits, compliance checks, and reporting to ensure accuracy and reduce risks.

Yes, they use anomaly detection to identify unusual patterns that may indicate fraud or errors.

No, they automate most tasks but flag complex or sensitive issues for human review.

They integrate with ERP, HRIS, accounting, and time-tracking systems, as well as tax compliance platforms.

They leverage advanced analytics and automation to ensure proactive compliance management.