AI Agents for Insurance Claims Validation

Insurance claims validation is a critical process that often suffers from inefficiencies, errors, and fraud risks. Our AI insurance claims validation agent is designed to streamline this process by automating data extraction, fraud detection, and claims routing. It helps insurers reduce operational costs, improve accuracy, and accelerate claim settlements, all while enhancing customer satisfaction. By incorporating insurance claims processing automation, insurers can further optimize their workflows and achieve significant cost savings.

discuss your projectACCELERATE CLAIM SETTLEMENTS WITH AI-POWERED VALIDATION AGENTS

Manual claims processing is costly, slow, and vulnerable to errors and fraud. Bluebash’s AI Insurance Claims Validation Agent streamlines the entire workflow—extracting data, detecting fraud, validating policy coverage, and routing claims in minutes. By embedding advanced machine learning and automation, insurers can cut costs, improve accuracy, and resolve claims faster. Whether managing property, auto, or health claims, this intelligent solution transforms operational efficiency while enhancing customer trust.

Challenges in Insurance Claims Validation

Traditional insurance claims processing relies heavily on manual methods, which are time-consuming, error-prone, and vulnerable to fraud. On average, claims take 3-5 days to validate, with error rates of 5-10% . Fraudulent claims account for 10% of total claims, costing the industry billions annually. For example, the Coalition Against Insurance Fraud estimates $122 billion in annual losses due to fraud. Manual data entry and document review are monotonous tasks prone to human error, while fraud detection struggles to keep pace with evolving tactics. These inefficiencies lead to higher costs, longer processing times, and dissatisfied customers. Implementing insurance claims processing automation can address these challenges by reducing manual intervention and improving overall efficiency.

How AI is Transforming Insurance Claims Validation?

AI is revolutionizing insurance claims processing by automating repetitive tasks, improving fraud detection, and enhancing accuracy. For instance, AI-powered systems can reduce processing time by 40-60% , detect 20-30% more fraudulent claims, and achieve data extraction accuracy rates of 95-98%. By leveraging predictive analytics, AI anticipates bottlenecks and optimizes resource allocation, ensuring faster settlements and better customer experiences. The integration of insurance claims processing automation into these systems further enhances their ability to handle high volumes of claims with minimal errors.

Key Features of Our AI Insurance Claims Validation Agent

Automated Insurance Claim Review

Extracts data from claim forms, police reports, and medical records using OCR and NLP models, achieving 95% accuracy. This feature is a cornerstone of insurance claims processing automation, enabling faster and more reliable data handling.

AI in Insurance Fraud Detection

Identifies fraudulent claims using machine learning models trained on historical data, detecting patterns and anomalies missed by humans.

Insurance Claim Approval Automation

Validates policy coverage and flags discrepancies for human review, ensuring compliance and preventing fraudulent payouts.

Claims Management AI Solutions

Routes claims to the appropriate adjuster based on risk scores and expertise, optimizing efficiency.

Automated Communication

Sends personalized updates to policyholders and alerts to adjusters, improving transparency and engagement.

Reporting and Analytics

Provides dashboards with insights into claims trends, fraud detection rates, and performance metrics.

Types of AI Agents in Insurance Claims Validation

Autonomous

Handles straightforward claims end-to-end, such as minor property damage, without human intervention. This type of agent benefits significantly from insurance claims processing automation, ensuring seamless workflows.

Copilot

Assists adjusters by providing fraud risk scores, policy validation results, and relevant data during claim reviews.

Autopilot

Automates entire workflows, including fraud detection and claims routing, while escalating high-risk cases to human adjusters.

Human-in-the-Loop

Combines AI automation with human oversight for complex cases requiring empathy or nuanced judgment. For example, personal injury claims are reviewed by human adjusters after AI processes initial data.

Ready to Modernize Your Insurance Claims Process with AI Agents?

Reduce fraud, accelerate settlements, and improve claims accuracy with Bluebash’s AI-powered validation agents. Automate the tedious, eliminate costly errors, and deliver faster, smarter insurance experiences.

LET'S CONNECTWhich Work is Better Human Work Vs Agent Work

Human Work

Speed

2 hours per claim

Accuracy

5% error rate

Scalability

Difficult to scale

Cost

$50 per claim

Agent Work

Speed

15 minutes per claim

Accuracy

0.5% error rate

Scalability

Easily scalable

Cost

$10 per claim

ROI of AI in Insurance Claims Validation

Implementing an AI-powered claims validation system delivers measurable benefits:

Reduced Fraud Losses

Detects 30% more fraudulent claims, saving $5 million annually.

Lower Processing Costs

Automation reduces costs by$20 per claim, saving $2 million annually for 100,000 claims.

Faster Settlements

Accelerates processing, improving customer retention by 10%, which can increase revenue by 5%.

Improved Accuracy

Reduces disputes and litigation, saving $1 million annually in legal fees.

Increased Efficiency

Frees up adjusters for complex cases, boosting productivity by 50%.

AI Interface for Insurance Teams

Our AI agents for insurance claims validation offer user-friendly interfaces tailored for adjusters and managers:

Dashboards

Displays real-time claims data, fraud detection rates, and performance metrics. Users can customize views to focus on relevant KPIs.

Alerts

Sends notifications for high-risk claims or manual review requirements, ensuring timely action.

User Interface

Provides a comprehensive view of claim details, policy coverage, and fraud indicators, enabling efficient decision-making.

Chat Interface:

Facilitates communication between adjusters, policyholders, and stakeholders, with real-time messaging and file sharing.

Approval Workflow

Automates approval processes for high-value or high-risk claims, ensuring thorough oversight.

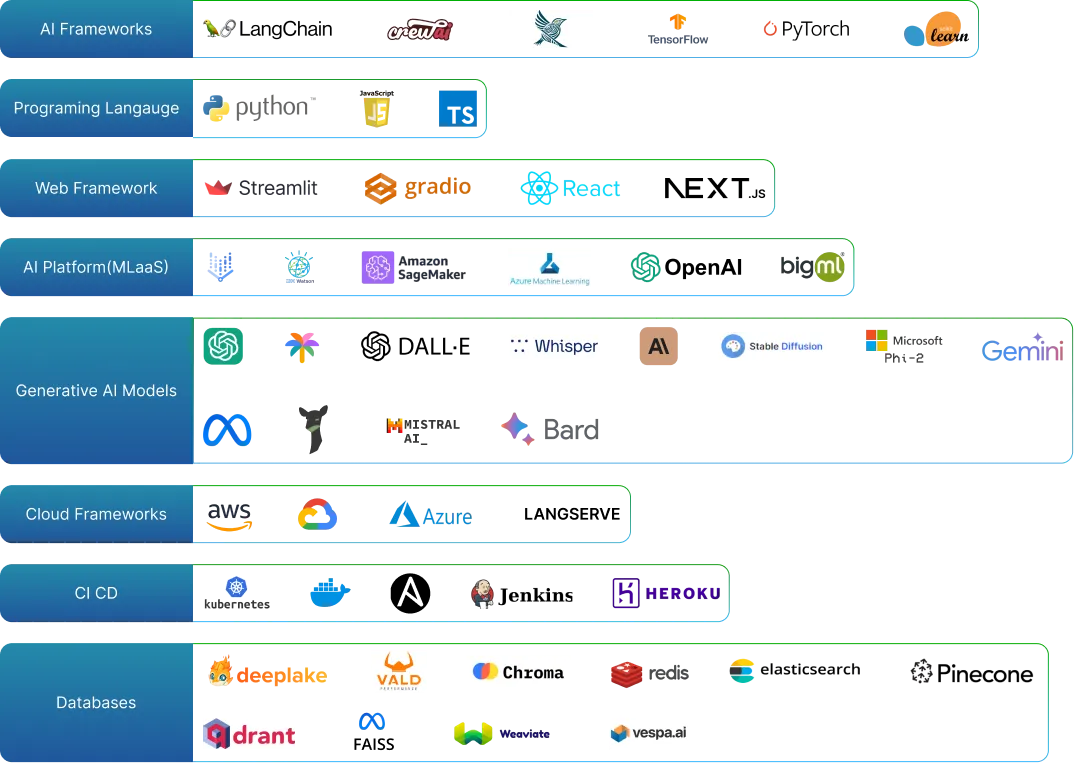

Artificial Intelligence Tools and Platforms

Explore cutting-edge AI tools and platforms for advanced analytics, machine learning, natural language processing, and innovative solutions.

Frequently Asked Questions

It’s an AI-powered system that automates data extraction, fraud detection, and claims routing to streamline insurance claims processing.

AI uses machine learning models to analyze patterns and anomalies in claims data, identifying fraud with greater accuracy than manual methods.

Yes. For sensitive or complex cases, the agent works in a human-in-the-loop model, providing insights while adjusters make final decisions.

Automation reduces processing costs by $20 per claim, saving millions annually for high-volume insurers.

By accelerating claim settlements, providing transparent communication, and ensuring accurate processing, it enhances the overall customer experience.