AI Agents for Corporate Tax Review

Corporate tax departments face increasing pressure to ensure compliance, accuracy, and efficiency in their filings. AI Agents for Corporate Tax Review are designed to automate repetitive tasks, detect discrepancies, and provide actionable insights, helping tax professionals streamline processes and reduce costly errors. These Corporate Tax Review AI Agents for Corporate Tax Review empower businesses to optimize tax management while freeing up resources for strategic financial planning.

discuss your projectOPTIMIZE TAX COMPLIANCE WITH AI-POWERED CORPORATE TAX REVIEW AGENTS

AI Agents for Corporate Tax Review automate the end-to-end tax assessment process—detecting discrepancies, ensuring regulatory compliance, and generating actionable insights. Equipped with machine learning and NLP, these agents streamline document categorization, compliance checks, and risk assessments while integrating seamlessly with ERP and tax platforms. They improve accuracy, reduce penalties, and free up tax professionals to focus on strategic planning. Scalable and intelligent, they offer a reliable solution for managing complex tax workflows with speed and precision.

Challenges in Corporate Tax Management

Corporate tax compliance is a complex and resource-intensive process. Traditional manual reviews are prone to errors, leading to penalties that cost companies millions annually. For example, Deloitte reports that errors in corporate tax filings result in an average of $1.7 million in penalties per year. Multinational corporations face additional challenges, such as navigating intricate transfer pricing rules and managing inconsistent reporting across subsidiaries. According to PwC, tax departments spend 60% of their time on compliance activities, leaving little room for strategic initiatives. These inefficiencies highlight the need for Automated Corporate Tax Compliance Agents to reduce errors, improve efficiency, and ensure compliance.

How AI is Transforming Corporate Tax Management?

AI is revolutionizing corporate tax workflows by automating repetitive tasks, enhancing accuracy, and providing deeper insights. AI-Powered Corporate Tax Management Agents use advanced technologies like machine learning and predictive analytics to identify discrepancies, optimize tax positions, and ensure compliance with ever-changing regulations. By automating up to 80% of manual data entry and reducing compliance review time by 50%, these agents enable tax professionals to focus on high-value tasks.

Additionally, Smart Corporate Tax Review Agents and Intelligent Tax Review Automation Agents are emerging as key tools in transforming tax management. These agents not only streamline workflows but also enhance decision-making by providing real-time insights into compliance risks and opportunities. The introduction ofAutomated Corporate Tax Assessment Agents further strengthens the ability of tax teams to handle complex regulations and large datasets efficiently.

Key Features of Our AI Agents for Corporate Tax Review

Document Categorization

Automatically organizes tax documents using Natural Language Processing (NLP) to extract key information like dates, amounts, and descriptions.

Discrepancy Detection

Identifies inconsistencies between tax filings and financial statements using machine learning models trained on historical data.

Compliance Checks

Ensures adherence to current tax laws by cross-referencing data against a continuously updated rules engine.

Actionable Recommendations

Provides AI-driven suggestions for correcting errors and optimizing tax positions, such as identifying eligible deductions.

Risk Assessment

Uses predictive analytics to assess compliance risks and recommend mitigation strategies.

Data Integration

Seamlessly connects with ERP systems, tax compliance software, and cloud platforms to access and process relevant data.

Continuous Improvement

Incorporates human feedback to refine AI models and improve performance over time.

Types of AI Agents in Corporate Tax Review

Autonomous

Handles straightforward tasks like document categorization and compliance checks independently.

Copilot

Works alongside tax professionals, automating routine tasks while requiring human oversight for validation and strategic decision-making.

Human-in-the-Loop

Flags complex or ambiguous cases for human review, ensuring compliance with nuanced regulations.

Ready to Automate and Simplify Corporate Tax Review with AI Agents?

Discover how AI-powered tax review agents can enhance accuracy, reduce penalties, and streamline compliance—empowering your tax team to work faster, smarter, and with greater confidence.

LET'S CONNECTWhich Work is Better Human Work Vs Agent Work

Human Work

Speed

Time-consuming, manual calculations

Accuracy

Prone to errors

Scalability

Limited by human capacity

Cost

High labor costs

Agent Work

Speed

Instantaneous analysis

Accuracy

Highly accurate (95%+)

Scalability

Handles large datasets effortlessly

Cost

Lower operational costs

ROI of AI in Corporate Tax Management

AI-Powered Corporate Tax Management Agents deliver measurable benefits:

Cost Savings

Automates routine tasks, reducing labor costs by up to 40%.Reduced Penalties

Minimizes errors, cutting penalty risks by up to 30%.

Improved Efficiency

Streamlines workflows, reducing compliance review time by 50%.

Enhanced Accuracy

Improves filing precision, leading to fewer audits.

Better Resource Allocation

Frees up tax professionals for strategic planning.

Faster Turnaround

Accelerates tax filing processes by up to 40%.

AI Interface for Corporate Tax Teams

Tax professionals interact with Corporate Tax Filing Review AI Agents through:

Dashboards

Visualize compliance status, discrepancies, and risk assessments using charts and graphs.

Automated Alerts

Receive notifications for critical issues requiring immediate attention.

Reporting Interfaces

Access clear, customizable reports summarizing findings and recommendations.

Feedback Mechanism

Provide input via a natural language interface to refine agent performance.

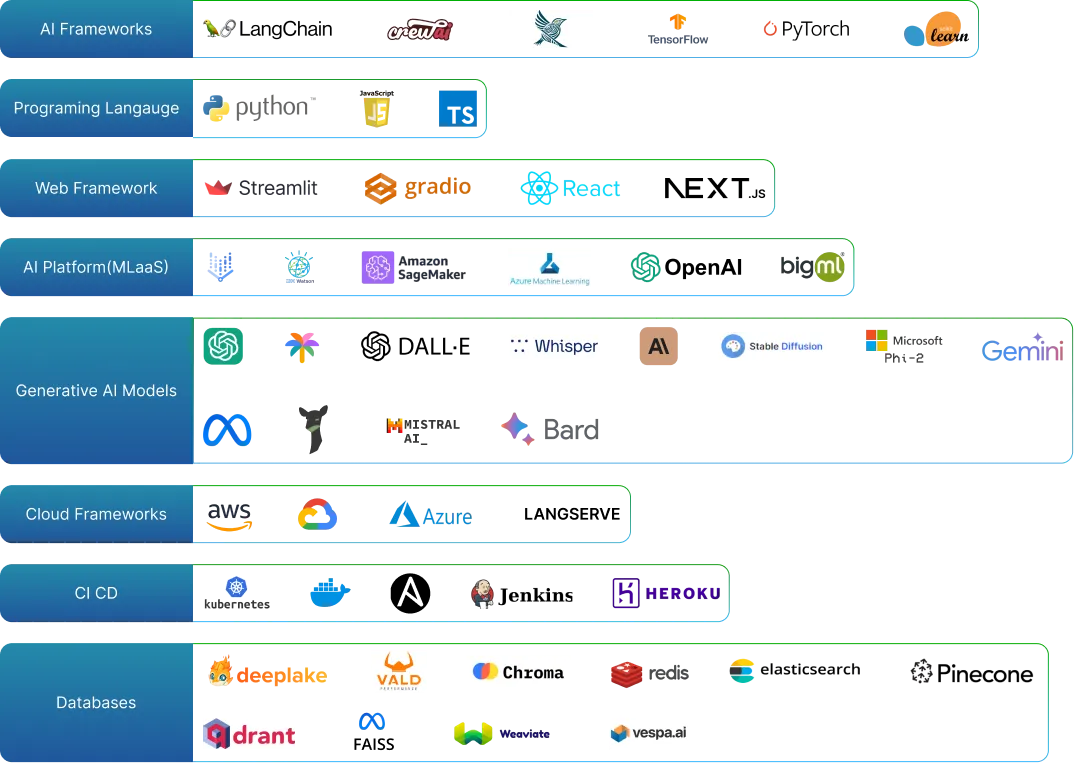

Artificial Intelligence Tools and Platforms

Explore cutting-edge AI tools and platforms for advanced analytics, machine learning, natural language processing, and innovative solutions.

Frequently Asked Questions

AI-powered tools that automate tax review processes, detect discrepancies, and ensure compliance with regulations.

They use machine learning models to identify errors and anomalies with over 95% accuracy.

Yes, it continuously updates its rules engine with the latest tax laws, but human oversight is required for ambiguous cases.

It integrates with ERP systems, tax compliance software, and cloud platforms to access and process data.

It reduces labor costs, minimizes penalties, improves efficiency, and frees up resources for strategic initiatives.