AI Agents for Account Risk Classification in Finance

The A2R Account Risk Classification Agent is an advanced AI solution designed to automate and optimize the process of identifying and managing financial risks associated with accounts. By leveraging machine learning and predictive analytics, this agent enhances accuracy, efficiency, and compliance in risk classification workflows. It is ideal for financial institutions, compliance teams, and risk management professionals seeking to reduce manual effort, improve decision-making, and mitigate financial risks.

discuss your projectAUTOMATE ACCOUNT RISK CLASSIFICATION WITH AI Agents

Manual risk reviews are slow, error-prone, and costly. With Bluebash’s A2R Account Risk Classification Agent, you can detect financial anomalies, classify risk levels, and generate compliance-ready reports—all in real time. Powered by machine learning and predictive analytics, this AI agent ensures accuracy, speeds up assessments, and reduces regulatory exposure. Gain confidence in your financial decisions with automated risk intelligence you can trust.

Challenges in Manual Account Risk Classification

Traditional methods of account risk classification rely heavily on manual processes, which are prone to errors, inefficiencies, and delays. These challenges include:

-

Misclassified Accounts

Human error leads to 20-30% of accounts being incorrectly categorized, skewing risk profiles and increasing exposure to financial losses.

-

Undetected Financial Risks

Subtle anomalies, such as changes in transaction patterns, often go unnoticed, delaying fraud detection and compliance actions.

-

Compliance Issues

Inaccurate classifications can result in non-compliance with regulations like AML and SOX, leading to fines ranging from $10,000 to $100,000 per violation.

-

Resource Inefficiency

Analysts spend up to 50% of their time on manual reviews, diverting attention from strategic tasks.

-

Financial Discrepancies

Errors in risk classification can lead to reporting inaccuracies, eroding stakeholder trust and damaging reputations.

How AI is Transforming Risk Classification in Finance?

AI is revolutionizing financial risk management by automating complex tasks and delivering actionable insights. Key advancements include

-

Machine Learning

AI agents for account risk scoring use ML algorithms to detect patterns and anomalies in transaction data, improving fraud detection accuracy by 20-30%.

-

Natural Language Processing (NLP)

NLP analyzes unstructured data, such as news articles, to assess market sentiment and identify risks, enhancing credit risk assessments by 10-15%.

-

Predictive Analytics

AI forecasts future risks by analyzing historical trends, reducing credit losses by 15-20%.

Key Features of Our AI Agents for Account Risk Classification

Transaction Analysis

Identifies anomalies in payments, invoices, and journal entries using clustering and anomaly detection algorithms.

Risk Benchmarking

Compares account behavior against predefined models based on industry standards and regulatory requirements.

Automated Risk Scoring

Classifies accounts into risk categories (low, medium, high) using machine learning and rule-based systems.

Comprehensive Reporting

Generates detailed risk classification reports with visualizations for compliance and audits.

Real-Time Alerts

Notifies users of high-risk accounts or unusual activities via customizable alerts

Compliance Automation

Monitors account activity and generates regulatory reports, ensuring adherence to AML and KYC requirements.

Continuous Optimization

Improves risk models over time using reinforcement learning and feedback loops.

Types of AI Agents in Account Risk Classification

Copilot

Automates the entire risk classification process, from data analysis to report generation, with minimal human intervention.

Human-in-the-Loop

Allows human oversight for complex or exceptional cases, ensuring accuracy in sensitive scenarios.

Ready to Eliminate Manual Errors and Strengthen Financial Risk Controls?

Bluebash’s AI-powered Account Risk Classification Agent automates risk scoring, flags anomalies, and streamlines compliance—giving your team accurate, real-time insights to make smarter financial decisions.

LET'S CONNECTWhich Work is Better Human Work Vs Agent Work

Human Work

Speed

Slow (4-8 hours per account)

Accuracy

Prone to errors (20-30% misclassification)

Scalability

Limited by human capacity

Cost

High labor costs

Agent Work

Speed

Fast (seconds to minutes)

Accuracy

Highly accurate (<5% error rate)

Scalability

Handles thousands of accounts

Cost

Lower operational costs

ROI of AI in Account Risk Classification

The A2R Account Risk Classification Agent delivers measurable benefits:

Cost Savings

Reduces manual effort by 30-50%, saving $15,000-$50,000 per analyst annually.

Improved Accuracy

Enhances risk classification accuracy by 25-35%, reducing financial losses and compliance penalties.

Efficiency Gains

Speeds up risk assessments by 40-60%, enabling faster decision-making.

Enhanced Compliance

Automates monitoring and reporting, lowering compliance costs by 20-30%.

AI Interface for Finance Teams

The A2R Account Risk Classification Agent provides an intuitive user experience:

Dashboards

Real-time insights into risk classifications, trends, and alerts, with drill-down capabilities.

Alerts

Customizable notifications for high-risk accounts or unusual activities.

Chat Interfaces

Conversational AI for querying reports and providing feedback.

User Interface

Tools for reviewing classifications, overriding recommendations, and manual assessments.

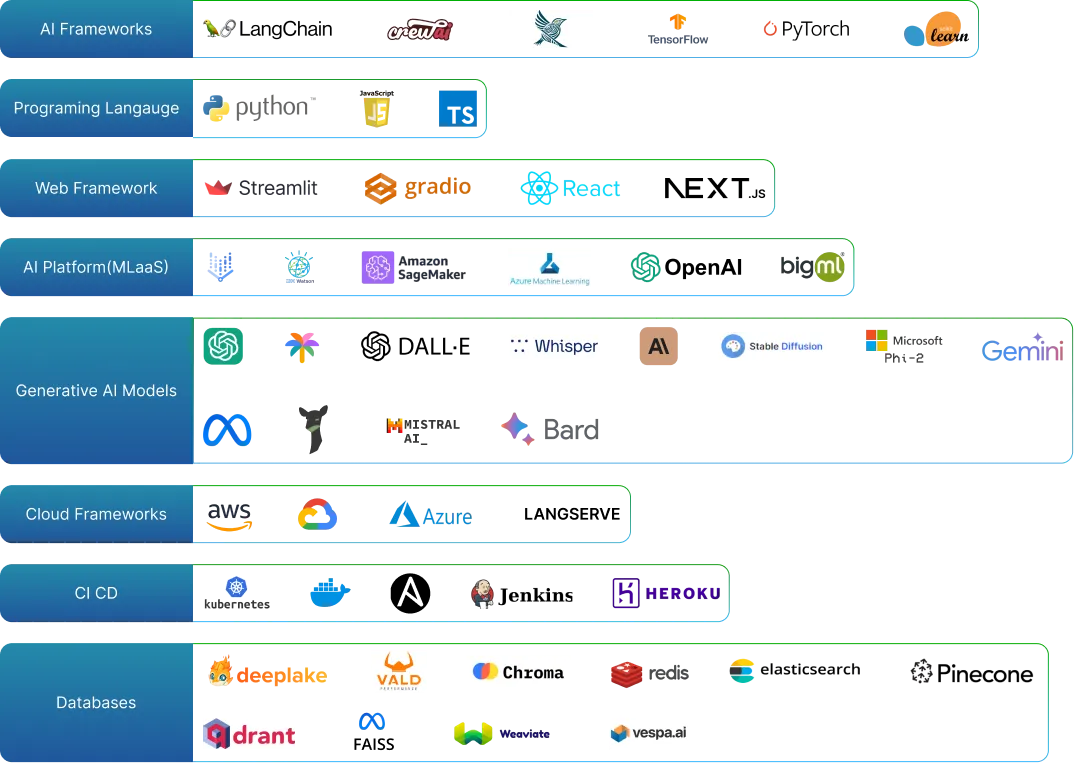

Artificial Intelligence Tools and Platforms

Explore cutting-edge AI tools and platforms for advanced analytics, machine learning, natural language processing, and innovative solutions.

Frequently Asked Questions

It is an AI-powered solution that automates account risk classification, improving accuracy, efficiency, and compliance.

It uses machine learning algorithms to analyze transaction patterns, detect anomalies, and assign risk scores.

Yes, it automates compliance monitoring and generates regulatory reports like SARs and CTRs.

It classifies accounts across industries and risk levels, including high-risk customers and complex transactions.

It reduces costs, improves accuracy, enhances compliance, and enables faster decision-making, delivering significant ROI.