What Is an AI Agent for Credit Evaluation and Why Does It Matter in 2026?

As we advance into an era where automation and intelligence define financial decision-making, AI agents for credit evaluation are emerging as the cornerstone of modern lending practices. In 2026, traditional methods of credit scoring and loan risk assessment are rapidly being replaced or enhanced by automated credit evaluation systems powered by artificial intelligence. These AI agents not only accelerate decision-making but also improve accuracy, reduce bias, and create more inclusive financial ecosystems.

In this blog, we'll explore what AI agents for credit evaluation are, how they work, and why they play a critical role in shaping the future of finance in 2026.

Understanding AI Agents for Credit Evaluation

An AI agent for credit evaluation is a software-based intelligent system designed to analyze a borrower's financial health and creditworthiness using machine learning (ML), data analytics, and automated reasoning techniques. These agents ingest and process vast amounts of structured and unstructured data — from income statements to social behavior — and deliver precise insights that help lenders make informed decisions.

Unlike static rule-based systems, AI agents continuously learn from new data and adapt to changing financial patterns. They don’t just assign credit scores; they offer comprehensive credit risk profiles, interpret real-time financial behavior, and flag potential risks proactively.

How Automated Credit Evaluation Works?

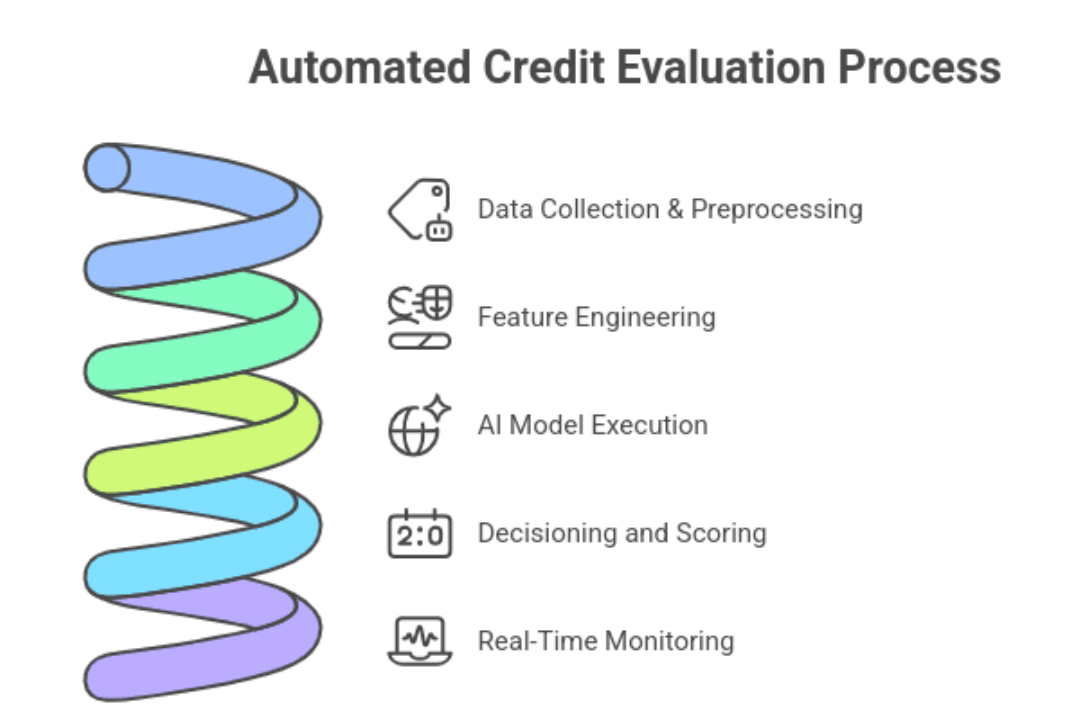

The process of automated credit evaluation using AI agents typically involves the following steps:

- Data Collection & Preprocessing

The AI agents do not only collect information provided by credit bureaus, banking history, utility bills, work history and even social media habits (with consent). Quality is ensured with the cleaning and standardization of data. - Feature Engineering

The system determines such features as the debt-to-income ratio, the repayment history, the job stability, and expenditures. Advanced agents also have the ability to include non-traditional measurements, which allows financial inclusion of thin-file customers. - AI Model Execution

The data is then processed using machine learning algorithms such as neural networks, gradient boosting machines or decision trees to deliver a prediction regarding the creditworthiness of the applicant. - Decisioning and Scoring

The AI agent provides a recommendation such as approve, deny or forward to be reviewed by a human being as well as a rating or credit score. - Real-Time Monitoring

The system continues to evaluate borrowers post-loan issuance, enabling real-time credit evaluation with AI agents. This helps institutions detect early signs of default and take proactive measures.

Why Automated Credit Evaluation Matters in 2026 ?

In 2026, the importance of automated credit evaluation has never been greater. The global financial ecosystem is more complex, diverse, and data-driven than ever before. Here's why AI agents are becoming indispensable:

- Speed and Efficiency

Thousands of applications can be analyzed by the AI agents in a few minutes, which would take days and even weeks by human analysts. This is not only a faster way of improving customer experience, but also enables lenders to expand operations without the need to have more employees. - Scalability and Cost Reduction

Be it a fintech start-up or a multinational bank, AI-driven systems allow scalable credit risk evaluation without the additional cost of high staffing an underwriting unit. Through intelligent automation, the financial institutions are able to save a lot in terms of operational costs. - Accuracy and Predictive Power

The AI agents find out minor trends and associations of data that a human being can easily miss. This translates to improved credit scoring, reduced defaults and improved health of the loan portfolio. - Inclusion and Accessibility

The conventional credit systems usually marginalize people who have a poor credit history. The AI agents increase the availability of credit by using alternative data points such as mobile phone usage, online transaction history and work habits. - Regulatory Alignment and Auditability

Modern AI credit analysis solutions are designed to comply with financial regulations and offer transparent decision-making processes that can be audited, improving trust in AI systems.

Credit Risk AI Agents: Managing Risk Like Never Before

Credit risk AI agents go beyond evaluating applicants — they help financial institutions manage overall credit exposure. These agents track ongoing financial behavior, economic indicators, and even geopolitical trends to dynamically adjust risk models. They can flag high-risk portfolios, suggest re-pricing strategies, or recommend pre-emptive interventions such as revised repayment terms.

In 2026, with rising economic uncertainties and digital lending surges, these risk-aware agents are crucial in ensuring the financial stability of lenders across the globe.

How AI Agents Reduce Bias in Credit Evaluation?

Bias in credit evaluation has long been a concern, especially for marginalized communities. Traditional credit systems often rely on limited historical data, which can reflect and reinforce existing socio-economic disparities. Here's how AI is reshaping this narrative:

- Inclusive Data Sources

The non-traditional and varied data data are taken into account by AI agents, including gig economy income or the behavior of making digital payments, equalizing the chances of the underbanked population. - Fairness-Aware Algorithms

The ethical AI models are produced in such a way that they reduce bias and exclude it through methods like adversarial debiasing or counterfactual fairness. - Continuous Model Audits

Current AI agent development companies incorporate surveillance devices that evaluate models of discriminatory results on a regular basis, which helps in adhering to the equitable lending policies. - Explainable AI (XAI)

Transparent and interpretable model outputs allow lenders and regulators to be aware and audit decision-making.

By deploying AI agents responsibly, financial institutions can build more equitable credit ecosystems that offer opportunities to a broader demographic.

Real-Time Credit Evaluation with AI Agents

One of the most transformative capabilities of AI in credit management is real-time evaluation. Unlike traditional systems that assess credit risk once at loan origination, AI agents continuously monitor borrowers' behavior. Here's what they can do in real time:

- Detect sudden drops in income or transaction activity

- Flag missed utility payments or late payroll deposits

- Update risk scores dynamically as borrower circumstances change

- Alert underwriters to take corrective actions (e.g., loan restructuring)

This continuous feedback loop helps prevent defaults and improves loan recovery rates — a game-changer for lenders in fast-moving economic environments.

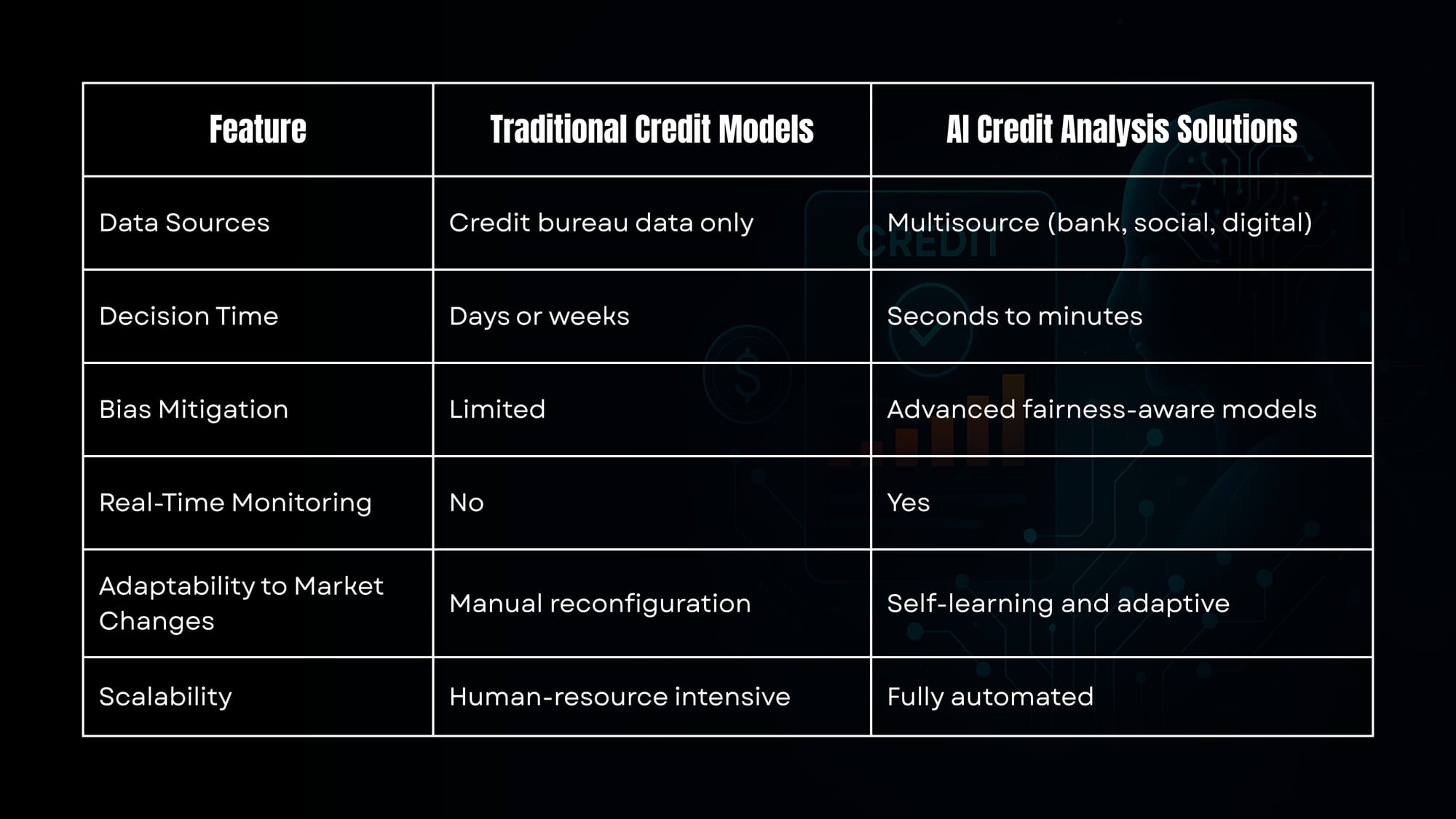

AI Credit Analysis Solution vs. Traditional Models

Why Choose Bluebash for AI Agents in Credit Evaluation?

At Bluebash, we develop intelligent, secure, and fair AI agents for credit evaluation that help financial institutions automate and improve credit decisions. Here’s why we stand out:

- Proven AI Expertise

We specialize in building custom AI agents tailored for credit risk analysis, backed by deep technical and financial domain knowledge. - Bias-Resistant & Explainable AI

Our solutions are designed to minimize bias and offer clear, auditable decision paths — promoting fairness and transparency. - Real-Time Credit Evaluation

We enable dynamic borrower monitoring with real-time risk assessment capabilities to reduce defaults and improve responsiveness. - Fully Customizable Solutions

From data pipelines to UI integration, we deliver end-to-end, scalable credit evaluation systems tailored to your workflow. - Compliance-Ready & Secure

Our platforms adhere to global regulations like FCRA, GDPR, and ECOA, with built-in data privacy and security best practices. Continuous Support

We offer long-term support, regular model updates, and performance tuning to keep your credit systems accurate and effective.

Future Outlook: AI and the Democratization of Credit

In 2026 and beyond, AI agents for credit evaluation will continue to redefine the boundaries of financial accessibility. With the integration of blockchain, decentralized identity (DID), and predictive behavioral analytics, future AI agents will provide even more personalized and secure credit solutions.

Financial institutions that embrace AI now will be better positioned to serve emerging markets, combat financial fraud, and empower consumers with faster, fairer, and smarter credit decisions.

Final Thoughts

As the financial industry evolves, automated credit evaluation is no longer optional — it's essential. From delivering real-time decisions to reducing systemic bias, AI agents for credit evaluation are reshaping how lenders assess risk and expand access to credit.

To stay competitive and future-ready in 2026, financial institutions must embrace intelligent, scalable, and ethical AI solutions. Partnering with a trusted expert like Bluebash ensures you get more than just technology — you get a strategic ally in building smarter, fairer credit systems.

FAQ's

- What is an AI agent for credit evaluation?

An AI agent for credit evaluation is an intelligent system that analyzes financial data to assess a borrower's creditworthiness. It uses machine learning to provide faster, data-driven lending decisions. - How does automated credit evaluation improve lending?

Automated credit evaluation reduces processing time, increases accuracy, and minimizes manual errors. It enables real-time decisions, better risk detection, and broader financial inclusion. - Can AI agents reduce bias in credit scoring?

Yes, AI agents can reduce bias by analyzing diverse data sources and applying fairness-aware algorithms. They promote equitable access to credit across all demographics. - What makes AI credit analysis better than traditional methods?

AI credit analysis uses real-time data, learns over time, and adapts to market changes. It’s faster, more inclusive, and better at predicting risk than legacy scoring models. - Why choose Bluebash for AI agent development?

Bluebash builds secure, bias-resistant, and fully customizable AI agents for credit evaluation. We ensure regulatory compliance, real-time insights, and ongoing support.